• Private Investments Lead for the 3rd Consecutive Quarter, Amidst a Sharp Decline in Public Investment

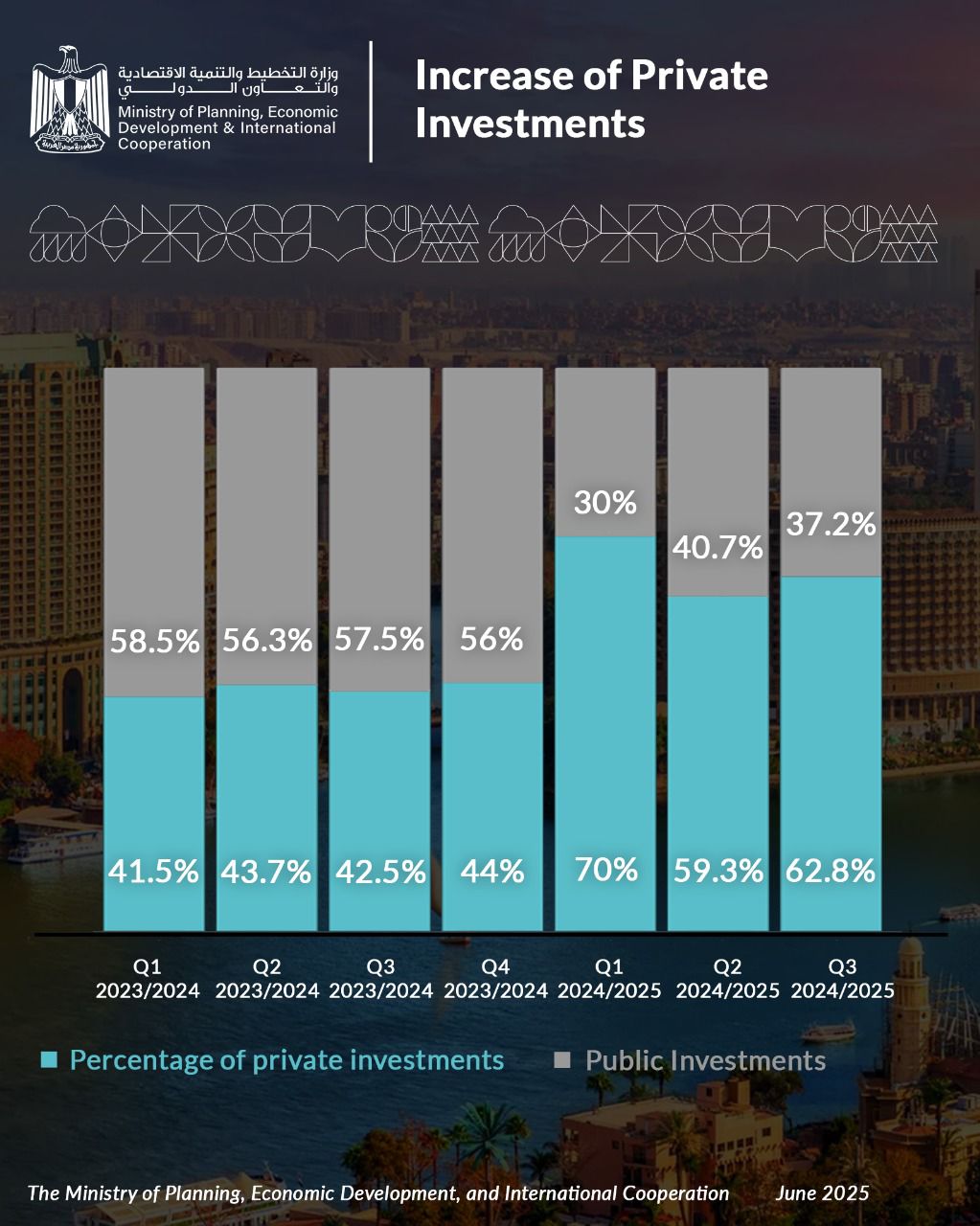

The Ministry of Planning, Economic Development and International Cooperation issued data on growth and investment rates in the third quarter of fiscal year 2024/2025 revealed an accelerated pace of private investment (at constant prices), growing by 24.2% year-on-year during the period to record EGP 142.8 billionThis marks the third consecutive quarter where private investment surpasses public investment, accounting for approximately 62.8% of total executed investments (excluding inventory).

In contrast, the share of public investment continued to decline, reaching 37.2%, totaling EGP 84.5 billion, down from EGP 155.3 billion in the same quarter of the previous fiscal year. This reflects the government’s efforts to restructure investment spending, rationalize public investments, and increasingly empower the private sector.

The ministry explained that, although private sector investment grew, it was not sufficient to offset the sharp contraction in public investment, which declined by 45.6% year-on-year at constant prices. This drop was primarily due to the implementation of investment spending governance measures. Consequently, the contribution of investment to economic growth was negative, subtracting 2.44 percentage points.

The recovery in private investment coincided with continued growth in real domestic credit directed to the private business sector, which averaged 11.7% during Q3 FY 2024/2025, before settling at 8% year-on-year by the end of April 2025.

The latest data indicates that the industrial sector received the largest share of private sector credit (43%). Credit growth is expected to accelerate further in the coming period, driven by the Central Bank's initiation of a monetary easing cycle, boosting the private sector’s ability to secure funding for expansion and investment.

The Purchasing Managers' Index (PMI) continues to reflect a recovery in private sector activity during Q3 of FY 2024/2025. At the start of 2025, the PMI recorded 50.7 points, its highest level in 50 months. In February, it remained above the neutral threshold at 50.1, indicating ongoing improvement in Egypt’s non-oil private sector. Although it slightly declined in March to 49.2, the index remained near the neutral level, signaling relative stability and continued recovery momentum in private sector activity.

Detailed GDP data show that, building on this momentum and as part of the state's broader efforts to support economic recovery and sustainable growth, the House of Representatives approved the Economic and Social Development Plan for FY 2025/2026 in June 2025, after its presentation on April 15 of the same year. The plan targets a growth rate of 4.5%.

The plan upholds the commitment to cap public investments at EGP 1.154 trillion for FY 2025/2026, in line with the government’s goals of rationalizing and governing public spending to strengthen macroeconomic stability and enhance the private sector’s role, while also attracting more foreign direct investment to finance development projects.

The plan places a particular emphasis on human development sectors, allocating approximately 47% of public treasury investments to health, education, and social services. This underscores the government’s strong belief in the importance of investing in human capital as a cornerstone of comprehensive and sustainable development.

The Ministry announced an increase in Egypt’s GDP growth rate during the third quarter of fiscal year 2024/2025, recording 4.77%, compared to growth rate of 2.2% in the corresponding quarter of the previous year — the highest quarterly growth rate recorded in three years.